Female entrepreneurs continue to show great promise. In American Express OPEN’s 2015 State of Women-Owned Business report, the amount of businesses owned by women increased by 74% between 1997 and 2015, and now, 30% of all businesses are owned by women. This fact, in addition to the 2013 reported statistic that women-led private technology companies are more capital-efficient and achieve 35% higher return on investment, demonstrates the benefits and success of female business leaders.

With missions like Indiegogo’s Women’s Day Entrepreneurship Initiatives, there is more support and interest than ever to cultivate and encourage women to become entrepreneurs. Society wants and understands the need for more female entrepreneurs, but the lack of female venture capitalists may be hindering this progress.

Venture capital can provide crucial funding to promising new business ventures. However, since the latter half of the 20th century, venture capital, or risk capital as it’s also known, is a predominantly male-dominated community that nurtures a male network. The term for this situation is homophily, which means “the tendency of individuals to associate and bond with similar others.” It’s hard to argue with the numbers when the total number of female capital partners is 6% and only about 10% of venture-funded startups are businesses founded by women.

In the Bay Area for example, the substantial reigning hub for startups and venture capital (VC) firms, there are just about 900 VC-backed female-founded startups out of the 9,000 VC-backed startups in total. The statistics are stunning, especially when you take into consideration that venture-supported businesses with woman leaders achieve 12% higher revenues than men-operated businesses.

The inclusion of more female venture capitalists would benefit startups, VC firms, and society in general. It is more profitable, more current, and more positive to the community. The current presence of women in both venture capital and startups is thriving through the trend of homophily. From the frequently cited Babson College report, “Venture capital firms with women partners are more than twice as likely to invest in companies with a woman on the executive team, and more than three times as likely to invest in companies with women CEOs.”

In general, 70% of female venture capitalists were in partnerships that had closed deals with women-led companies. A growing trend in the VC industry is that many female venture capitalists choose to start their own firms to actively change the gender inequality that exists.

While women can collaborate together to build a greater community for female venture capitalists, they exercise under the limitations of being the minority. There must be a call for change on a grander scale. There’s a systemic problem in which women who want to be in the venture capital industry need to have a background in particular subjects (computer science, engineering, etc.), but these subjects have traditionally been encouraged to males. The important changes we need to see in this area will take time. What can be addressed immediately is how businesswomen are viewed by the existing majority in venture capital.

There must be an effort to see women as venture capitalists first, not as females first. Because men have been the norm for venture capital, I believe there is an unconscious bias that suggests women are not prepared or capable of being venture capitalists for a variety of archaic reasons. One reason being that women have traditionally been seen as homemakers and the primary source of child-rearing. So, in an environment in which the men present are not expected to care for the family and home, women are at a disadvantage for not being supported by the system if they choose to also be a parent.

Another archaic reason is the narrow-minded idea that women are too cautious to succeed in risk capital. It is ignorant to assume that women are too risk-averse. The reality is, women bring any number of successful characteristics to the table because of their experience as women.

“I firmly believe women are superior investors as they are more likely to stay on course, tinker less, and empower their portfolio companies,” says Rita Ferrandino, a founding partner at Arc Capital Development. Ferrandino is one of the nation’s top strategists, an expert in STEM education, and is well-versed in early-stage investment capital. “Arc Capital Development,” she says, “is committed to having a portfolio of companies with female founders and co-founders like Snug Vest, Education Modified, and KickBoard to name a few.”

In her experience, she has noticed that men display more overconfidence in entrepreneurial ventures and investments. “By contrast, women are more likely to recognize and acknowledge when they don’t know something. Generally speaking, women have more humility when it comes to investing,” Ferrandino says. Although humility is admirable, she urges women to “stop apologizing and just rejoice in our accomplishments and celebrate our skills and talents.” Of course she’s right, women work hard, are qualified, and deserve to be proud of their successes.

Nevertheless, the male venture capitalists that dominate the industry must do their part to vanquish the gender inequality that’s rampant in VC firms. This issue directly hinders women, both established and aspiring, from fulfilling and exercising their full potential in this industry. What they should recognize by now is that if women are struggling, then venture capital and startups as a whole will struggle.

Ferrandino urges, “The more male VCs who lead by example in addressing gender inequality, the more men and women will thrive in the workplace. For example, [to the male VCs] don’t participate in panels where there are no women panelists. Find women and provide mentorship. Openly discuss the importance of being a good father and a good employee, and show the need for work balance [with a family life].”

She concludes that there are many small things male VCs can do to daily to make a difference and lead by example. Again, she’s absolutely right. The progress we want will not be immediate, but if the venture capital community can work together to instill the beliefs that will better sustain and cultivate gender equality, then it will be worth it.

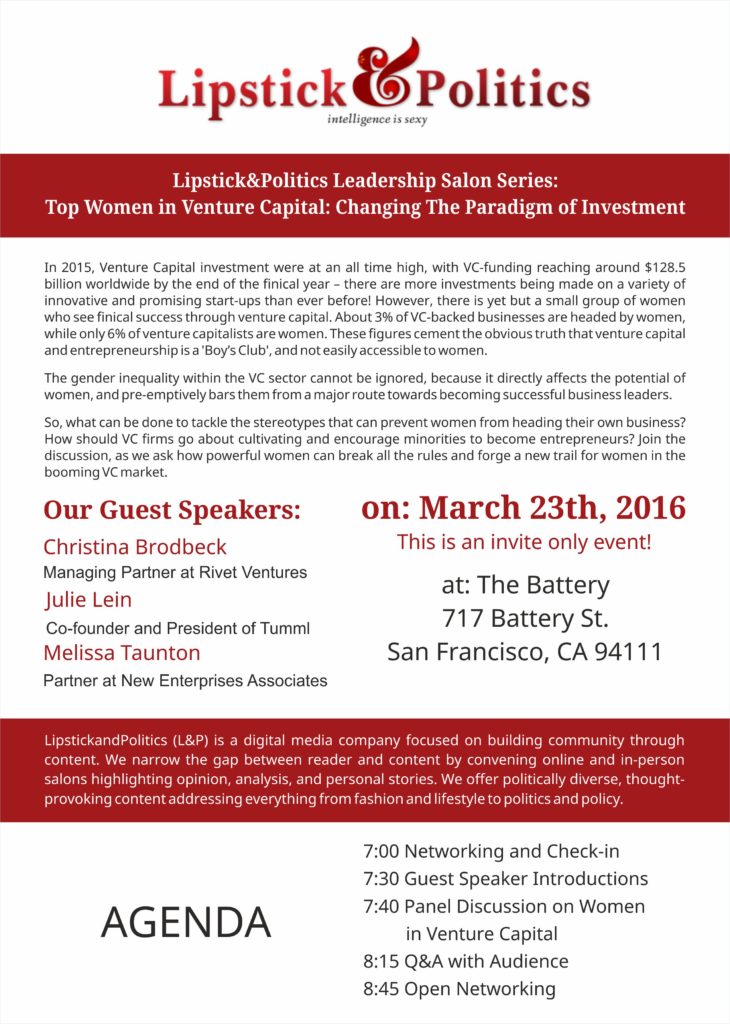

To discuss this further, here is the private event we will be holding on this topic.